Agricultural Industries Energy Taskforce Update

Taskforce background

- Taskforce established Sept 2014 in response to impact of rising electricity prices on viability of agricultural production

- Membership grown to around 14 agriculture industry organisations across Australia

- Cotton, sugar cane, wine, dairy, pork, winter crops, pasture for livestock industries.

- Energy cost increases threaten role of agriculture in producing the food and fibre consumed by all Australians, as well as jobs and export income

- $15 billion (value of production) Irrigated Ag sector particularly hard hit due to cost of pumping, but also areas with need for cooling.

Advocacy focus

- Highlight loss of competitive position for Australia’s agricultural industries – and market failure in the provision of energy

- Network supplied electricity should be a cost-effective energy source for food and fibre producers

- High energy costs = loss of competitive advantage for agriculture industries

- Flow on effects for rural communities, loss of business, job losses.

- Focus on water – energy nexus issues

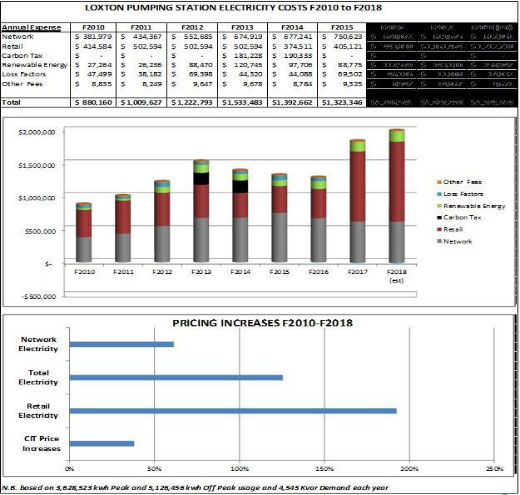

Case study: Loxton Pumping Station SA

What is needed?

- Reform of network charging to deliver around 30% reduction in electricity prices

- Price for electrons averaging 8 cents/Kw hour

- Volume based food and fibre tariffs

- Revaluing the Regulated Asset Base (RAB) of network businesses to remove the impact of historic over investment from the underlying cost base.

What is needed?

- More teeth for AER to scrutinise and test proposals submitted by network companies to the AER (pricing process)

- Closer examination of the weighted average cost of capital (WACC) of network companies, and

- Separate formulas for calculating WACC for private and state-owned networks

- Examination of performance of networks in relation to global benchmarks and actual service delivered

- Improved tariff regimes for irrigation industry

- Australian Energy Market Commission (AEMC) rule change that would enable irrigators, and all farmers, who are large users of electricity, to be separately classified customers

Irrigating sugar cane Bundaberg region

Action taken

- Direct engagement with decision makers.

- Campaign of correspondence

- Taskforce representation on advisory c’tees and consumer panels incl AER, ECA, ACCC.

- Participation in numerous consultation sessions

- Appearance before Australian Competition Tribunal and Senate and House of Reps Committees.

Submissions

7-odd submissions to Govt related inquiries: some include:

- Australian Govt Competition Policy review (Harper)

- Australian Govt white paper on agriculture competitiveness

- Dept of Industry & Science review of Aust energy markets governance arrangements

- ACCC review of retail electricity pricing

- Removal of the Limited Merits Review

- Productivity Commission review of Australian agriculture

- Finkel Review

- Senate inquiry in electricity network companies

- House of Reps standing ctee on modernising the grid

- COAG Energy Council Consumer participation in revenue determinations

- AER Discussion paper on profitability measure

Finkel report key points

- Increased security

- Future reliability

- Rewarding consumers

- Lower emissions

- Finkel report vision to be enabled by 3 pillars :

- Orderly transition

- System planning

- Stronger governance

Finkel report key pointsFinkel blueprint focused on 4 key outcomes :

Finkel outcomes

- Finkel has set significant tasks over 2017 to 2020 with clearly stated timelines for key bodies to undertake various work.

- A significant package of energy security obligations for the Australian Energy Market Commission (AEMC) to fulfil by mid – 2018.

- By mid-2018, the AEMO and AEMC to:

Investigate & decide on a requirement for all synchronous generators to change their governance settings to provide a dead band similar to comparable international jurisdictions, and …. Consider the costs and benefits of tightening the frequency operating standard

Canola crop, Southern NSW

National Energy Guarantee

- Will the Government’s NEG deliver results?

- NEG did not pursue Clean Energy Target (CET) rec. by Finkel

- NEG sought to focus on reliability, while considering Australia’s commitments under the Paris Agreement.

- Proposed that the policy will be finalised in 2018, with reliability guarantee expected to become effective by the end of 2019 and the emissions guarantee expected to become effective by end of 2020.

- Federal legislation not required.

- Consultation occurred with States at Nov 2017 COAG Energy Council.

- SA & ACT govts campaigning against the NEG arguing it would hurt the renewable energy industry, and not drive down power prices.

ACCC inquiry into retail

- Our submission highlighted that, for irrigating businesses, where electrically pumped water is a primary input to agricultural production the rise in cost of production means that:

costs cannot be passed on to price sensitive consumers, without affecting demand and profitability, and……. agricultural production is reduced and profitability squeezed, and in many cases, agricultural producers search out alternative sources of power supply.

ACCC Chairman

CCC Chairman Rod Sims, National Press Club, Sept 2017:

- Raised issues of anti-competitive behaviour

- Highlighted prices doubling over 10 years, or by 1/3 (depending on how measured)

- Over 40% of costs due to network prices, higher retail costs & margins 24%, generation costs 19% and green costs 16%

- Impacts of closure of Hazelwood and Northern power stations.

- Observations regarding changes in bidding patterns with such behavior allowed under the rules.

- Removal of Limited Merits Review, sought by ACCC & AER

Loading cotton for export to China, Nevertire, NSW

Are we making progress?

- Removal of the Limited Merits Review

- Moves to enable the AER more teeth : Taskforce recs include:

AER adopt a performance measurement framework to enable an accurate assessment of the profitability of regulated electricity and gas businesses, comparable to that of other ASX entities.

- The AER be allowed to compare the actual profitability of the regulated entity to:

- The allowed return on equity from its regulatory determination,

- Actual profit of other regulated entities, and

- Actual profit of other businesses operating in the Australian economy.

Some positive steps:

Support for the AER to…

Seek a greater level of data from electricity companies, including information on:

- Return on Assets

- Return on Equity

- Economic profit

- Operating profit per customer

We also recommended…

- Changes to the weighted average cost of capital (WACC) for transmission and distribution businesses, and

- A comprehensive assessment of the economy-wide costs and benefits of revising the electricity network and transmission businesses’ regulated asset base (RAB) to efficient levels.

Tariff review

- And a review of network tariffs to examine and ensure that irrigators and other businesses in non-congested parts of the network are not forced to meet the costs of network investments made to overcome congestion in other parts of the network

Harvesting sugar cane, Mackay Qld

Strategic partnerships

- Energy Consumers Australia grants to undertake necessary work with focus on advocacy & research

- Continued engagement with the Australian Renewable Energy Agency (ARENA) to ensure agriculture is a key priority as ARENA.

- Continued engagement with the Clean Energy Finance Corporation (CEFC) to identify opportunities to undertake projects on behalf of the irrigated agriculture sector for investment in renewable energy and low emissions technology.

Monitor progress

- Significant activity over the coming years – driven by the various reviews & inquiries & COAG Energy Council.

- Continue to push for energy price reductions – to remove competitive barriers for the agriculture sector.

- Taskforce to maintain a watching brief.